An interesting real time example of the recursive cycle of lawmaking, as described e.g.

here by Halliday and Carruthers, is unfolding in the ongoing drama of the UK Public Accounts Committee's hearings on tax avoidance by Google, Starbucks, and Amazon. Richard Murphy has posted a

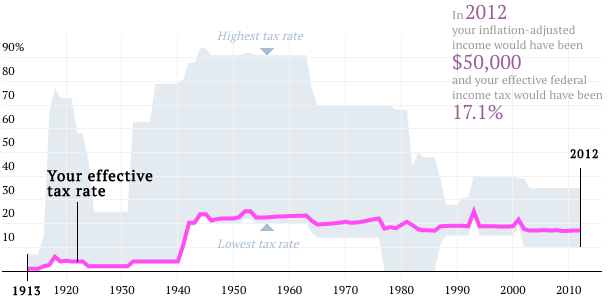

press release issued by the PAC today in which they hit a lot of core tax policy notes: what "fairness" requires in taxation, the duty of taxpayers to the state, the state's duty toward taxpayers as a group, the problem of taxpayer morale when perceptions of unfairness abound, the role of morality in taxation.

But it also draws a picture of contestation in both the domestic and the global lawmaking spheres, drawing in ideas about and challenges to the rule of law, standards, and norms, and involving legal and nonlegal actors. Halliday & Carruthers point to four mechanisms that drive the recursive cycle forward and lead to phases of legal change: the indeterminacy of law, contradictions, diagnostic struggles, and actor mismatch. The press release suggests we have all four of these drivers in play.

Excerpts:

"Global companies with huge operations in the UK generating significant amounts of income are getting away with paying little or no corporation tax here. This is outrageous and an insult to British businesses and individuals who pay their fair share.

...There is little credible information about what is going on. The evidence we took from large corporations was unconvincing and, in some cases, evasive. HMRC also lacked clarity when trying to explain its approach to enforcing the corporation tax regime. The inescapable conclusion is that multinationals are using structures and exploiting current tax legislation to move offshore profits that are clearly generated from economic activity in the UK.

HMRC should be challenging this but its response so far to these big businesses and their aggressive tax planning has lacked determination and looks way too lenient. Policing the tax system must be at the heart of what HMRC does.

So we see the PAC taking on a role as a fiduciary for the people and claiming that the state revenue authority has failed in its own duty to act in that capacity: the result has been indeterminacy of law, contradictions and diagnostic struggles as per H&C.

The PAC calls for naming and shaming of "offenders" (difficult when all these companies claim full compliance with all applicable laws), and for transparency and fairness in the administration of the tax regime by HMRC, that "Government has a responsibility to assess and collect tax due from all taxpayers, without fear or favour," and that "[i]f companies do not pay their fair share of tax, other taxpayers have to pay more." As a result, the PAC says "[b]oth HMRC and corporate taxpayers are failing to meet the legitimate public expectations from the tax system."

This essentially frames multinationals as lawbreakers with HMRC in an accomplice role, whether intentionally or out of neglect. The PAC says "it will always be an unequal fight between HMRC and multinational companies," but calls on the revenue authority both to be more agressive in chasing MNCs and to do more to publicly explain why these companies pay so little. We can interpret this to mean that the PAC seeks to involve more public input into this cycle of legal change, i.e., introducing more actor mismatch.

You can read the rest of the press release at the link above. Will be interesting to see what comes of it, whether the PAC succeeds in driving forward legal change and whether we will be able to identify a beginning and end of a particular recursive cycle of tax lawmaking (H&C say this is generally very difficult to do, since so many variables are involved in legal change). So far on the part of Starbucks, the result seems to be PR/damage control, in the form of public assertions of willingness to pay a bit more. That just underscores the effectively voluntary nature of international taxation when it comes to MNCs--Starbucks is negotiating with the state--and won't address any of the issues raised by the PAC, so the contestation should continue and may bring in more actors and more struggle.